Four factors which determine premiums

The type

of vehicle you drive

Your insurance costs are determined, in

part, by the claims costs associated with the year, make and model of the

vehicle that you drive. Claim costs may be lower for a vehicle that has more

safety and loss prevention features, such as air bags and anti-lock brakes.

See more information.

Where

you live

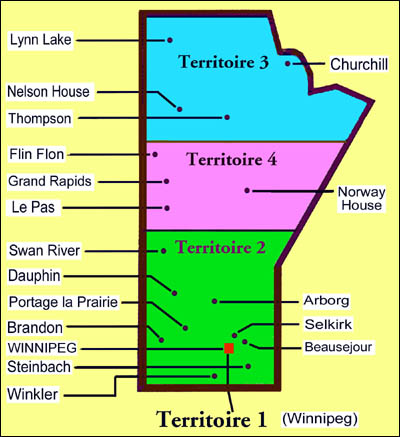

Manitoba is divided into four territories for

vehicle rating purposes (see map on left). Each geographic region is identified

with varying degrees of risk; the lower the risk, the lower your insurance

rates.

If you're commuting from Territory 2 (municipalities bordering Winnipeg) and driving into Winnipeg (Territory 1) to go to school or work (more than four days a month or more than 1,609 km in one insurance year), your risk of a claim will be greater than those who do not commute into Winnipeg.

For example, a student who lives in Territory 2 but travels to Winnipeg twice a week to attend college should insure as a commuter.

What you use it

for

Insurance rates differ depending on what you use your

vehicle for. That's because what you use your vehicle for affects how likely you

are to have a claim. For instance, if you only drive to the grocery store and

back (pleasure use) you're less likely to have a claim than if you drive your

vehicle regularly to go back and forth to work (all-purpose).

Your driving

record

How much you pay for your driver's licence and vehicle

premium also depends on your record of safe driving.

Safe driving means lower premiums. High-risk driving means higher premiums. Premium discounts depend on your Driver Safety Rating (DSR). The longer you've driven safely – with no traffic convictions, at-fault claims or alcohol- or drug-related administrative suspensions – the higher your DSR will be, and the more savings you qualify for.

A safe driving record could save you up to $30 off the full cost ($45) of your driver's licence premium. You could also save up to 46 per cent on your vehicle premiums.

Do you have more questions about how your rates are determined? Here are some additional details.